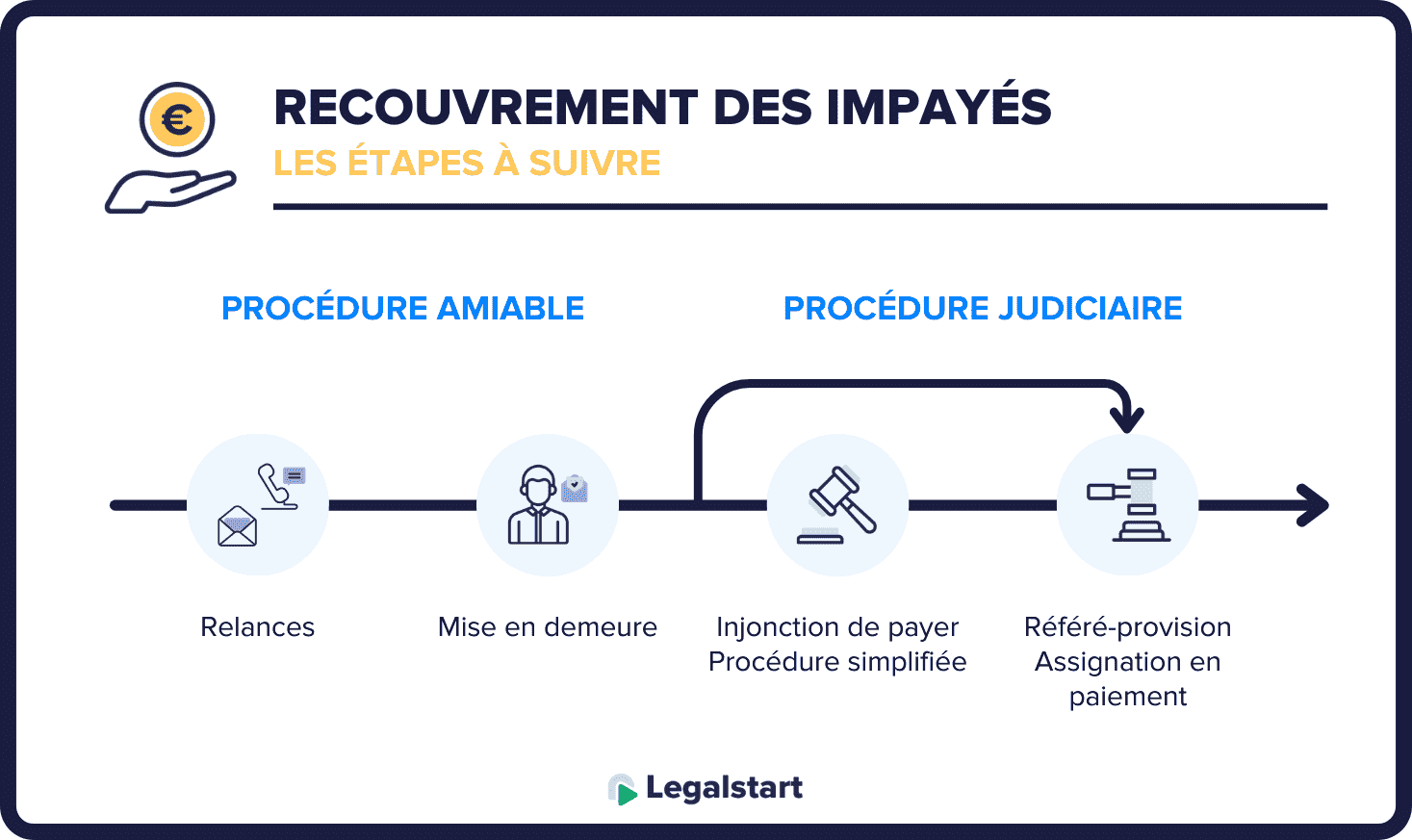

Dealing with unpaid bills can be a frustrating and time-consuming task for any business owner. However, there are legal procedures in place to help you recover these debts. In this article, we will explore three common methods: the injunction to pay, the interim provision, and the payment assignment. We will also discuss a simplified procedure for recouping smaller amounts. So, let’s get started!

L’injonction de payer

L’injonction de payer is a legal procedure that is used to recover debts arising from contracts, such as unpaid invoices, rent, or overdrafts, as well as debts resulting from bills of exchange or acceptance of professional claims. To initiate this procedure, you must first gather all the necessary documents to support your claim. This includes completing the appropriate form and providing supporting evidence, such as proof of non-payment or a formal demand for payment.

Once you have compiled the necessary documentation, you must submit your dossier to the appropriate court. It is important to note that the injunction to pay procedure is non-adversarial, meaning that the judge will make a decision based solely on the evidence presented in your dossier, without considering the debtor’s arguments.

If the judge rejects your request, you do not have any further recourse. However, you may still choose to pursue a traditional legal procedure. If the judge deems your request justified, they will issue an order to pay, which has enforceable power. You must then serve the request and the order to pay to the debtor within six months, with the help of a judicial officer.

If the order to pay is accepted and the debtor does not contest it within one month, they are required to pay the debt. If they fail to do so, you can proceed with enforcement measures, such as seizing their assets or freezing their bank account.

Le référé-provision

Le référé-provision is a quick procedure designed to obtain payment for a debt. With this procedure, the judge issues a judgment for payment as long as the debt is not contested. The creditor must provide sufficient evidence to demonstrate the debtor’s liability and ensure that the debtor will not contest the claim.

To initiate this procedure, you must file a request with the appropriate court. If the judge validates your request, they will issue a provisional enforceable order, allowing you to demand payment from the debtor. If the debtor fails to pay voluntarily, you can proceed with enforcement measures, such as seizing their assets.

If the judge rejects your request, your only option to recover the debt is to pursue a payment assignment.

L’assignation en paiement

L’assignation en paiement is a traditional legal procedure. It is a lengthier and more costly process compared to the previous methods, but it allows for a more thorough examination of the debtor’s arguments.

This procedure is typically pursued when both the injunction to pay procedure and the interim provision procedure have been unsuccessful for the creditor.

At the end of this procedure, if the creditor is successful, they can obtain a judgment ordering the debtor to pay the debt. In case of non-compliance, the creditor can use more coercive measures to enforce the judgment.

Cas particulier : la procédure simplifiée de recouvrement des impayés

La procédure simplifiée de recouvrement d’impayés is specifically designed for smaller debts resulting from contracts or statutory obligations, with amounts less than €5,000. This procedure involves a judicial officer.

To initiate this procedure, the creditor must submit a dossier through an online platform for the treatment of small claims. The creditor must provide the judicial officer with the following information:

- The debtor’s identity

- Proof of the unpaid debt

- A description of the negotiation margin left to the judicial officer to recover the debt

The judicial officer will then send an invitation letter to the debtor, inviting them to participate in the procedure via registered mail with acknowledgement of receipt.

The debtor has one month to respond to the invitation:

- If they accept the procedure, the judicial officer will propose a payment agreement. If both the creditor and the debtor agree to the proposal, the judicial officer will issue an enforceable title, and the debtor must make the payment, or they will be subject to enforcement measures.

- If they refuse the procedure, the creditor must take the case to court to obtain an enforceable title.

It is important to note that each of these procedures has its own costs, which vary depending on the method chosen.

Now that we have explored the various procedures for recovering unpaid debts, let’s discuss some measures you can take to protect yourself from such situations.

Avoiding unpaid bills

There are a few tricks to help you avoid unpaid bills:

- Send one or more reminders before the payment deadline.

- Clearly state the applicable late payment penalties.

- Offer flexible payment options, such as installment plans.

- Request an upfront payment or deposit to ensure at least a minimum portion of the total amount is received and to mitigate any financial difficulties.

Protecting against unpaid rent

For businesses involved in renting properties, the best way to avoid unpaid rent is to carefully select your tenants. Be sure to thoroughly assess their financial stability and consider requesting guarantors if necessary.

Another option is to take out rent guarantee insurance or “garantie loyers impayés” (GLI). This type of insurance protects you against the risks of unpaid rent, unpaid charges, and potential damages caused by the tenant.

By following these tips and using the appropriate legal procedures, you can increase your chances of recovering unpaid debts and protect yourself from future financial losses.

Disclaimer: This article provides general information only and does not constitute legal advice. Consult with a legal professional for advice tailored to your specific situation.